heic-jpg.ru

Tools

Preapproval For A Personal Loan

Personal loan pre-approval is your chance to understand your borrowing power better. When you apply for your loan, if pre-approved, you will receive a. After applying online, you'll get an automated email – almost immediately – saying whether or not you're pre-approved. Then usually within 2 business hours. Loan pre-approval and prequalification are effectively the same process for personal loans. Pre-approval gives you an estimate of the loan rate and terms. You're preapproved for a personal loan! · 1 Get started by entering your online banking user ID and password. · 2 Answer a few simple questions and provide any. Pre-qualify for a loan with good or bad credit and compare monthly payment options from several lenders in under 2 minutes. How much would you like. Mortgage Preapproval · Apply for a Mortgage · Home Buying Center · Mortgage Basics Personal Loan Options. Personal Expense Loan. If you need a personal. If a lender deems you an acceptable risk, they may pre-approve you for a loan. The lender will offer you an unofficial look at the rates and amount of credit. After submitting your personal loan prequalification form, you'll quickly see your potential loan terms. A prequalified loan offer will show the loan amount you. Personal loan preapproval, sometimes called prequalification, is a process where lenders use a soft credit check to see whether or not you're likely to qualify. Personal loan pre-approval is your chance to understand your borrowing power better. When you apply for your loan, if pre-approved, you will receive a. After applying online, you'll get an automated email – almost immediately – saying whether or not you're pre-approved. Then usually within 2 business hours. Loan pre-approval and prequalification are effectively the same process for personal loans. Pre-approval gives you an estimate of the loan rate and terms. You're preapproved for a personal loan! · 1 Get started by entering your online banking user ID and password. · 2 Answer a few simple questions and provide any. Pre-qualify for a loan with good or bad credit and compare monthly payment options from several lenders in under 2 minutes. How much would you like. Mortgage Preapproval · Apply for a Mortgage · Home Buying Center · Mortgage Basics Personal Loan Options. Personal Expense Loan. If you need a personal. If a lender deems you an acceptable risk, they may pre-approve you for a loan. The lender will offer you an unofficial look at the rates and amount of credit. After submitting your personal loan prequalification form, you'll quickly see your potential loan terms. A prequalified loan offer will show the loan amount you. Personal loan preapproval, sometimes called prequalification, is a process where lenders use a soft credit check to see whether or not you're likely to qualify.

Not available for Secured Loans or Debt Consolidation Loans exceeding $25, All loan applications are subject to review and credit approval. Terms offered to. How to get a personal loan · Step 1. Step 1: Apply online. Tell us how much you want to borrow, plus details about your income, housing and employer. · Step 2. Many lenders offer the opportunity to prequalify with a soft inquiry into your credit. Being prequalified doesn't guarantee that you'll get the loan, but it. Here are some simple explanations of the factors considered in your loan application. Credit Score -> or higher. A pre-approved personal loan offer means that you've met certain borrowing requirements and are likely to qualify for the loan. You deserve a great loan. Stress free! ; Fast results. Get results in minutes and money in your account in as little as one business day, if approved. ; Flexible. A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly. A pre-approved personal loan is basically a top-up instant personal loan given to existing customers with history of punctual repayment and a good credit score. If you've checked your loan offers with us recently, you might have noticed some offers are '% pre-approved'. This means that, based on the information you'. There are no origination fees, you receive a fixed rate for the life of your loan and you could receive the funds the same day you're approved. Fast and. Yes. Pre approval assumes that the information provided by the borrower is true and accurate. When moving forward with the actual mortgage, the information of. If you are pre-approved, it means that a lender has stated that you qualify for a mortgage loan based on the information you have provided, and subject to. How to get prequalified for a loan · Consider your financial situation and needs · Research and compare lenders · Fill out the prequalification form · Undergo a. This loan is a very popular way to get cash for a specific need such as debt consolidation, home repairs, major household purchases, educational expenses. If you're a Cornerstone member you may have a pre-approved personal loan offer available in mobile and online banking. approved for a loan, and 6 months later. What is a pre-approved Personal Loan? · The bank may have analysed your credit history with them and noted a healthy bank balance and transaction rate. · Rapid. Mortgage Preapproval · Apply for a Mortgage · Home Buying Center · Mortgage Basics Personal Loan Options. Personal Expense Loan. If you need a personal. A pre-approved personal loan is basically a top-up instant personal loan given to existing customers with history of punctual repayment and a good credit score. If you're looking for loans from a credit union, borrowing is easy with Vibe's pre approved personal loans with online approval Personal Loan. Our. When applying for an unsecured personal loan, we look at factors like your credit report and income, rather than securing a loan through collateral. With our.

Victoria Secret Payment Methods

Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase amount, may vary by merchant, and may not be available in all states. A down payment. If you're a frequent Victoria's Secret or PINK shopper and have good credit, the Victoria's Secret Credit Card is an option. It offers special. Klarna is an alternate payment method that allows you to split your purchase into 4 interest-free payments. To use Klarna to pay for your purchase on. Return Options · Requesting a returns label · Payments · What payment methods do you accept? What is a credit card security number? Manage Saved Cards. What payment methods does Victoria's Secret accept? Victoria's Secret accepts payment via Victoria's Secret credit card, Visa, Mastercard, American Express. Buy your own Victoria's Secret Gift Card easily online with 60 secure payment methods & instant email delivery! Requests to change your payment method require contacting Customer Care using the Contact Options listed in the "Need More Help?" section below. Buy now, pay later at Victoria's Secret with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. If you need additional assistance, contact Customer Care. Customer Care. (Victoria's Secret Credit Card) . Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase amount, may vary by merchant, and may not be available in all states. A down payment. If you're a frequent Victoria's Secret or PINK shopper and have good credit, the Victoria's Secret Credit Card is an option. It offers special. Klarna is an alternate payment method that allows you to split your purchase into 4 interest-free payments. To use Klarna to pay for your purchase on. Return Options · Requesting a returns label · Payments · What payment methods do you accept? What is a credit card security number? Manage Saved Cards. What payment methods does Victoria's Secret accept? Victoria's Secret accepts payment via Victoria's Secret credit card, Visa, Mastercard, American Express. Buy your own Victoria's Secret Gift Card easily online with 60 secure payment methods & instant email delivery! Requests to change your payment method require contacting Customer Care using the Contact Options listed in the "Need More Help?" section below. Buy now, pay later at Victoria's Secret with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. If you need additional assistance, contact Customer Care. Customer Care. (Victoria's Secret Credit Card) .

Need to find a gift for her? Consider giving a Victoria's Secret eGift Card at eGifter today! Buy Victoria's Secret gift cards at eGifter and pay with. Need to find a gift for her? Consider giving a Victoria's Secret PINK eGift Card at eGifter today! Buy Victoria's Secret PINK gift cards at eGifter and pay. You will also see several different payment options including PayPal and Venmo. Victoria's Secret Webpage - Step 2 - Mobile. Step 3 Use Your Shipito Address. Earn $ Rewards for every $ spent1 $20 Rewards for VIP4. Birthday Savings!2. Free Shipping Days3. More Details Rewards Terms & Conditions. You can also mail a payment to the address listed on the back of your credit card or on your billing statement. For information on phone payments, you can call. Buy Bitcoin with Victoria's Secret Gift Card. Buy BTC, ETH, USDC, USDT, DAI and more cryptos worldwide using + payment methods. Four easy payments Pay in four installments over six weeks. · No surprises. Payments are automatically made from your linked debit or credit card every two. "Card" means each credit card we issue for your Account, as applicable. "Credit Plan" means one or more payment program options Victoria's Secret may ask us to. Your Order, Delivery Terms, Returns & Refunds, Ways to Pay, VS Evoucher terms and conditions (UK only), Promotional Offers, Multibuys and Bundles, Sale, Events. No, we are only able to accept one form of payment. Can I use PayPal and a Gift Card, Merchandise Card or Cardmember Reward? Yes, Gift Cards, Merchandise Cards. Which payment methods are accepted? Klarna currently accepts all major debit and credit cards (i.e., Mastercard, Visa, AMEX, Discover). Please note, prepaid. payment, statement, pay, card, Angel Card, Credit, Credit Card. Views More Contact Options. Live chat:Chat with an Expert. SIGN UP & GET IN THE. If you have recently received your new Victoria's Secret or PINK Credit Card, please be sure you have activated it before attempting to make a purchase online. VICTORIA'S SECRET / PINK CREDIT CARD: For all inquiries related to the Victoria's Secret or PINK Credit Card, including bill payment, payment authorizations. When placing an order on heic-jpg.ru, only one credit/debit card may be used per order. ACCEPTED PAYMENT METHODS: Visa. MasterCard. ADDITIONAL. Online stores give you the option to choose between Visa or Mastercard debit and credit cards. That's why DolarApp could be the ideal solution to simplify your. They accept all credit and debit cards. How do refunds work with Buy Now Pay Later? All refunds will be issued according to the store's policy. Pay your Victorias Secret Credit Card (Comenity) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the. What's the difference among the Victoria & PINK Credit Card, and the Victoria & PINK Mastercard Credit Card? More Contact Options. Live chat:Chat with.

Does The Red Cross Pay For Blood Donations

Canadian Blood Services standard blood donation is approximately mL, slightly less than half a litre or two cups. The average adult has about 5 litres. Did you know one blood donation can save up to three lives? Just think about how many lives you could change by coming back for more. How your donated red. No. The Red Cross blood donation process at our blood drives and donation centers will not change. Blood, platelet and plasma donations will be screened using. The American Red Cross Blood Donor App puts the power to save lives in the palm of your hand. Donating blood, platelets and AB Plasma is now easier than ever. The disaster assistance the Red Cross provides is free, made possible by voluntary donations of time and money from the American people. Give Blood Careers. The Red Cross takes whole blood, platelets, red cells, and plasma, but does not compensated the donor like CSL and Biolife. In the Czech Republic, you can either donate plasma for money or donate both blood and plasma for free. If you do it for free, Red Cross. What fees are associated with blood? While donated blood is free, there are significant costs associated with collecting, testing, preparing components. Here's the breakdown from our audited financial statements of our mission-related spending in FY $ billion. Collects nearly million blood donations. Canadian Blood Services standard blood donation is approximately mL, slightly less than half a litre or two cups. The average adult has about 5 litres. Did you know one blood donation can save up to three lives? Just think about how many lives you could change by coming back for more. How your donated red. No. The Red Cross blood donation process at our blood drives and donation centers will not change. Blood, platelet and plasma donations will be screened using. The American Red Cross Blood Donor App puts the power to save lives in the palm of your hand. Donating blood, platelets and AB Plasma is now easier than ever. The disaster assistance the Red Cross provides is free, made possible by voluntary donations of time and money from the American people. Give Blood Careers. The Red Cross takes whole blood, platelets, red cells, and plasma, but does not compensated the donor like CSL and Biolife. In the Czech Republic, you can either donate plasma for money or donate both blood and plasma for free. If you do it for free, Red Cross. What fees are associated with blood? While donated blood is free, there are significant costs associated with collecting, testing, preparing components. Here's the breakdown from our audited financial statements of our mission-related spending in FY $ billion. Collects nearly million blood donations.

The American Red Cross, a non-profit organization, does not pay their donors, but they do sell the blood they collect. Red Cross Communications Manager Christy. The American Red Cross Blood Donor App puts the power to save lives in the palm of your hand. Donating blood, platelets and AB Plasma is now easier than. In addition to supplying blood products to all five University of California health systems, the Red Cross also manages the American Rare Donor Registry, which. Approximately 30, units of red blood cells are needed every day in the U. S. Donating blood is a small way to give back and it does so in such a mighty way. Although the Canadian Red Cross Society no longer has a role in Canada's blood donation system, the society was involved in the collection of voluntary. Donors are compensated starting at $ The collection involves the insertion of a needle into one arm and blood is removed from one arm into a collection bag. The American Red Cross says million lives are saved every year by blood donations, so maintaining the blood supply is critical. How do I participate in. The disaster assistance the Red Cross provides is free, made possible by voluntary donations of time and money from the American people. Give Blood Careers. To schedule an appointment, log onto heic-jpg.ru (sponsor code: goblue) or call RED-CROSS (). Before Your Donation. All drives on. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. You can donate: Whole blood every 56 days for males, every 84 days for females. Plasma every 6–14 days, depending on the donor program; Platelets every 14 days. The FREE Blood Donor app puts the power to save lives in the palm of your hand. Find nearby Red Cross blood drives, schedule and manage appointments, complete. According to the Red Cross, if you received a COVID vaccine, you may still donate blood. Knowing the name of the manufacturer of the vaccine is important in. It is a precious resource, but has a limited shelf life—only days for platelets and 42 days for red blood cells. That's why it takes 1, donors a day to. Red Cross Biomedical Services is the largest single supplier of blood and blood products in the U.S.. . Follow. . Posts. Find the nearest Red Cross blood, platelet or plasma donation center. Make a difference in someone's life, give the gift of life. The concept of non-remunerated blood donations was uncommon at the time. Instead, the practice of paid blood donations initiated by private blood banks was. We work with Versiti Blood Centers and the American Red Cross to host blood drives at various Northwestern Medicine locations. Why You Should Consider Donating. Your monetary donation to the Red Cross helps provide food, shelter, relief supplies, emotional support, recovery planning and other assistance during disasters. Your journey to becoming a life-saver could start with a blood donation. Give blood today and save up to three lives, plus you'll get a limited-edition bandage.

How To Start Making Money In Stocks

1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. C: Current quarterly earning growth should be high. You should only look at quarter to quarter increase to avoid seasonality. And the growth rate should be at. The keys to winning in the stock market is to only buy stocks during market up trends, focus on the companies with the biggest earnings growth, and buy stocks. There are two ways you make money from investing. One is when the shares increase in value (and you profit when you sell), the other is when they pay dividends. So before investing in stocks, do your research as they are risky. One day they go up high and the next you can crash on your face. Also keep in. Banks will usually fund these businesses as well, they've proven to make money. start investing with Yieldstreet>>. Join Yieldstreet. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. 4) Stay in cash during a Bear Market. 5) Never argue with the Stock Market; it is always right. 6) Concentrate your stock buying and watch your stocks closely. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. C: Current quarterly earning growth should be high. You should only look at quarter to quarter increase to avoid seasonality. And the growth rate should be at. The keys to winning in the stock market is to only buy stocks during market up trends, focus on the companies with the biggest earnings growth, and buy stocks. There are two ways you make money from investing. One is when the shares increase in value (and you profit when you sell), the other is when they pay dividends. So before investing in stocks, do your research as they are risky. One day they go up high and the next you can crash on your face. Also keep in. Banks will usually fund these businesses as well, they've proven to make money. start investing with Yieldstreet>>. Join Yieldstreet. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. 4) Stay in cash during a Bear Market. 5) Never argue with the Stock Market; it is always right. 6) Concentrate your stock buying and watch your stocks closely.

Getting started early can help your money work harder. Time has the potential to benefit the growth of your investing accounts. See how starting early could. Nothing in the Stock Market Is Guaranteed · Know You're Betting on Yourself · Know Your Goals, Timeframe and Risk Tolerance · Research, Research, Research · Keep. Buy and sell without Technical Analysis - get started today! Get up to 12% returns with your Dividend stocks. Investing is a way to increase your wealth by putting the money you earn to work for you. If you havent started, now is a great time to start. As you now. 1- Make a Stock Photo Website or Blog. 2- Make a Stock Short duration Video Blog or website. 3- Make a Stock WordPress Template. William J. O'Neil's national bestseller, How to MakeMoney in Stocks, has shown over 2 million investors the secrets to building wealth. get started. With that said I would say you could start making trades successfully using the methods in this book. The author has a verifiable track record. So the two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock. Putting money in the stock market, for example, will not make you a Given the benefits of compounding, it is always better to start investing early rather. How Do Startup Investors Make Money? · If the startup is acquired by another business · If the startup lists on the public markets, through an Initial Public. Index funds. They are the best way to make money in stocks. Index funds put their money in indexes like the S&P or the Russel Index. Basic Concept: The most straightforward method is buying a stock at a lower price and selling it at a higher price. This can be done with. How to earning money from dividends One way investments generate income is through dividends. If you have invested in a company by buying shares, for example. Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick investments · Step 5. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. Making money in stocks is a great way to add additional income to your personal balance sheet whether you're investing long-term or day trading. The key is to. People aim to make money from investing in shares through one, or both, of the following ways: An increase in share price. Usually known as 'capital growth' or. Through every type of market, William J. O'Neil's national bestseller, How to MakeMoney in Stocks, has shown over 2 million investors the secrets to building. I had no idea what I was doing. Like I said, I got lucky. When I look back on it, my first memory of the stock market will be watching our money. When you start with $10,, that would be $ per trade. As a goal, you should try to make times as much money as you risk. So if you risk $, try.

Companies Of Facebook

Facebook, Inc. operates as a social networking company worldwide. The company engages in the development of social media applications for people to connect. Here's how to create a Facebook Page for your business. Add your business name and description. Name your Page after your business, or another name that people. What Companies Are Owned by Facebook? · Instagram ($1 billion) · WhatsApp ($19 billion) · Oculus VR ($2 billion) · com (undisclosed sum) · LiveRail ($ million). As of August Meta Platforms (Facebook) has a market cap of $ Trillion. This makes Meta Platforms (Facebook) the world's 7th most valuable company. Meta ranks among the largest American information technology companies, alongside other Big Five corporations Alphabet (Google), Amazon, Apple, and Microsoft. From self-serve to full-service, here are the best companies for your next Facebook video ad campaigns · Sharp Eye Animation · Tongal · VidMob · Easy Sketch Pro. Meta Platforms (formerly Facebook, Inc.) is a technology company that has acquired 91 other companies, including WhatsApp. The WhatsApp acquisition closed. Today we're celebrating the three million advertisers on Facebook with a new tool that empowers each business to tell their unique story. The Meta Company Products are, together, the Meta Products and other products provided by the Meta Companies that are subject to a separate, stand-alone terms. Facebook, Inc. operates as a social networking company worldwide. The company engages in the development of social media applications for people to connect. Here's how to create a Facebook Page for your business. Add your business name and description. Name your Page after your business, or another name that people. What Companies Are Owned by Facebook? · Instagram ($1 billion) · WhatsApp ($19 billion) · Oculus VR ($2 billion) · com (undisclosed sum) · LiveRail ($ million). As of August Meta Platforms (Facebook) has a market cap of $ Trillion. This makes Meta Platforms (Facebook) the world's 7th most valuable company. Meta ranks among the largest American information technology companies, alongside other Big Five corporations Alphabet (Google), Amazon, Apple, and Microsoft. From self-serve to full-service, here are the best companies for your next Facebook video ad campaigns · Sharp Eye Animation · Tongal · VidMob · Easy Sketch Pro. Meta Platforms (formerly Facebook, Inc.) is a technology company that has acquired 91 other companies, including WhatsApp. The WhatsApp acquisition closed. Today we're celebrating the three million advertisers on Facebook with a new tool that empowers each business to tell their unique story. The Meta Company Products are, together, the Meta Products and other products provided by the Meta Companies that are subject to a separate, stand-alone terms.

Facebook can help your large, medium or small business grow. Facebook for Business gives you the latest news, advertising tips, best practices and case studies. The top five Social Media Marketing companies specializing in Facebook Advertising are: Jives Media (5-stars and reviews); Social Media 55 (5-stars and Facebook Inc. is an American company based in Menlo Park, California. The company owns the social network Facebook, the video and photo sharing app. Companies Currently Using Workplace by Facebook ; Leena AI, heic-jpg.ru, Centre Road, Suite B, Wilmington, DE ; Oregon Veterinary Medical Association. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented, virtual and mixed reality to help build the next evolution in social. The Facebook company is now Meta. We've updated our Terms of Use, Privacy Policy, and Cookies Policy to reflect the new name on January 4, Facebook wordmark. Log in. Cover photo of Leading Real Estate Companies of the Built for quality real estate companies, LeadingRE is an invite-only business-. Best Facebook Marketing Agencies · SmartSites. (51 reviews) · Ignite Visibility. (14 reviews) · Intero Digital. (25 reviews) · BrainZ Digital. ( Latest data for these companies · WILLOW ROAD, MENLO PARK, CA, , United States · MACARTHUR BLVD STE , IRVINE, CA, , United States · What companies use Facebook Ads? Some of the companies that use Facebook Ads include Unidades V4 Company, BuscarVagas - Empregos e Consultoria Brasil. Facebook, American online social network service that is part of the company Meta Platforms. Facebook was founded in by Mark Zuckerberg. The Facebook company is now Meta. We've updated our Terms of Use, Privacy Policy, and Cookies Policy to reflect the new name on January 4, Boost your career or add value to your company with Meta Blueprint certification through Meta agency education program and get verified with valued media. Facebook wordmark. Log in. Cover photo of Leading Real Estate Companies of the Built for quality real estate companies, LeadingRE is an invite-only business-. The 5 Top Facebook Ad Companies in the World · 1. NP Digital – The Best Overall Facebook Ads Company · 2. Hibu – The Best Facebook Ads Company for an All-in-One. We've done the hard work and vetting for you and compiled a list of the best Facebook advertising companies in the world — check it out now to get started! View Facebook (heic-jpg.ru) location in California, United States, revenue, industry and description. Find related and similar companies as well as. Who uses Workplace by Facebook? ; Country, United States ; Revenue, MM ; Company Size, ; Company, iAdvize. Facebook signed its first global music licensing deal with Universal Music Group in Grow your business across Facebook, Messenger, Instagram, WhatsApp and Quest. Choose a business goal. Reach it faster with heic-jpg.ruram.

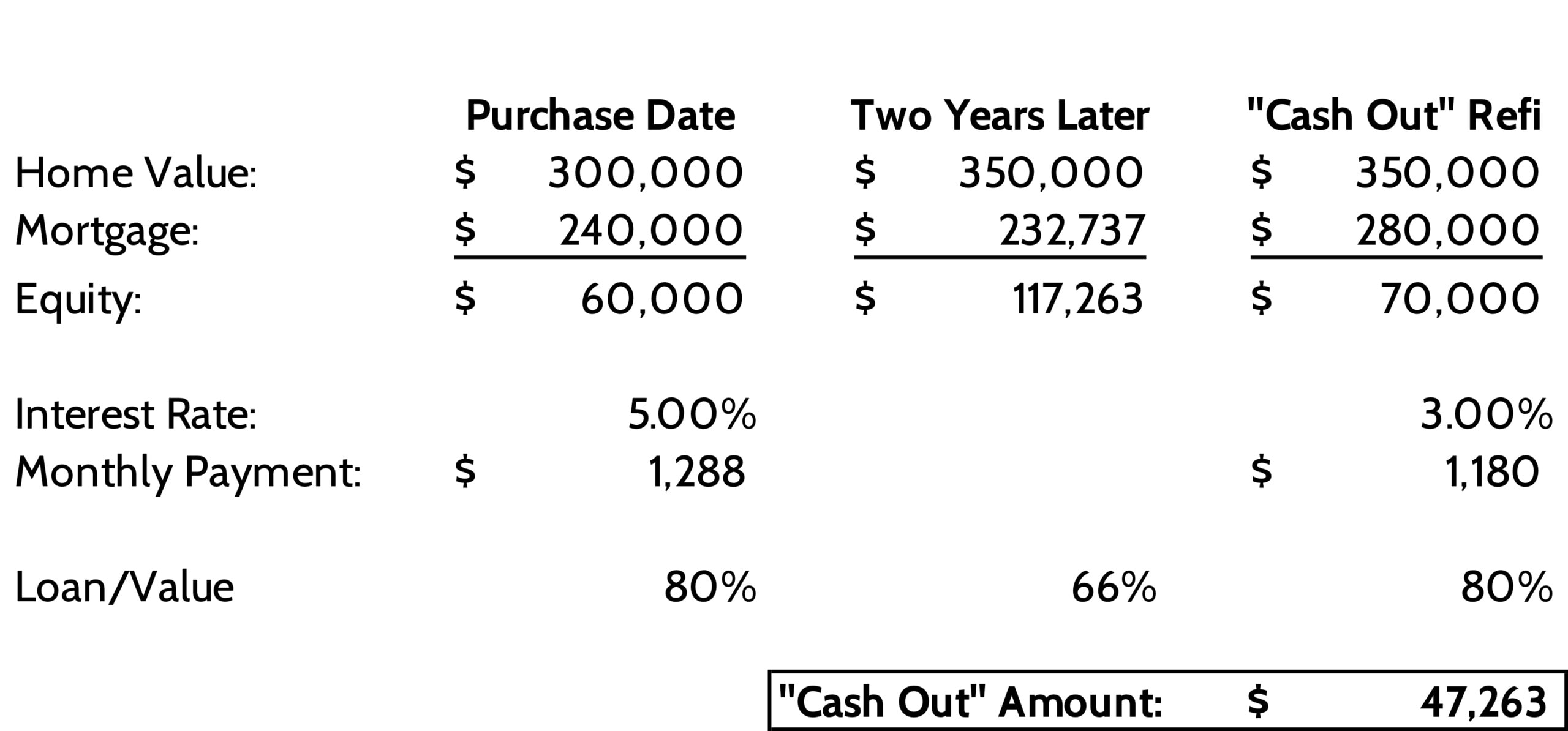

Interest Rates On Refinance Cash Out

Lenders typically charge higher rates for cash-out refinances than rate-and-term refinances. Think a cash-out refinance is right for you? See Personalized Cash-. It typically falls between and Keep in mind; credit scores affect loan rates differently. If your score is on the lower end, expect to be charged a. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · Curent VA Cash-Out Rates ; Year VA Cash-Out Refinance, %, %, ($) ; Year VA Cash-Out Jumbo Refinance (Based on a $, loan amount). Since the interest rate on your mortgage will likely be lower than your credit card and loan rates, you could enjoy lower payments. Make a big purchase. Buying. As of November , the average year fixed mortgage rate is %. A cash out refinance would yield you a better rate, if you bought your home in when. Cash-out refinance rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed. Rate. %. APR. Conventional Cash-out Refinance Loan · % · %APR. As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount —. Lenders typically charge higher rates for cash-out refinances than rate-and-term refinances. Think a cash-out refinance is right for you? See Personalized Cash-. It typically falls between and Keep in mind; credit scores affect loan rates differently. If your score is on the lower end, expect to be charged a. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · Curent VA Cash-Out Rates ; Year VA Cash-Out Refinance, %, %, ($) ; Year VA Cash-Out Jumbo Refinance (Based on a $, loan amount). Since the interest rate on your mortgage will likely be lower than your credit card and loan rates, you could enjoy lower payments. Make a big purchase. Buying. As of November , the average year fixed mortgage rate is %. A cash out refinance would yield you a better rate, if you bought your home in when. Cash-out refinance rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed. Rate. %. APR. Conventional Cash-out Refinance Loan · % · %APR. As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount —.

Your interest rate will increase or decrease when the index increases or decreases. Your lender may also offer you a fixed-rate loan option that would allow you. Use that extra cash to: · Lower interest rates than a personal loan or credit card · No additional monthly payments · Longer repayment terms · No prepayment. An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. It could be a smart money move if you can qualify for a lower interest rate. Also consider options such as a HELOC or a home equity loan. If you've been. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. rate mortgage to a fixed one or if interest rates have dropped. Today's rates. As Take cash out to pay off high-interest debt or make home improvements. A rate-and-term refinance is when a mortgage loan is refinanced by replacing the existing mortgage with a new loan, usually with a lower interest rate. A cash-. Refinance Your Mortgage and Save · Get a Better Loan. Refinance to a lower rate or pay off your loan faster with a shorter term. · Take Cash Out. Use the equity. Cash-out Refinance · % · %. Refinance Rates Today · Term Length Options: · Rate Range: · Year Fixed Rate · % - % APR · Year Fixed Rate · % - % APR · Year Fixed Rate. Refinance rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed. To enjoy the benefits of debt consolidation, you should not carry new credit card or high interest rate debt. By refinancing your existing mortgage, your total. Keeping the maximum 80% LTV ratio requirement in mind, you may borrow up to an additional $60, with a cash-out refinance. To calculate this, multiply your. When is a cash-out refinance loan a good idea? · If you want a lower interest rate: If current mortgage rates are lower or your credit score has improved since. You can refinance your existing loan by using a rate-and-term refinance to get a lower interest rate, change the loan term or length, or change the loan type. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs to your loan. With a cash-out refinance, you might be able to get a lower interest rate and larger loan amount than with a personal loan or other alternative. Tips for Using the Cash-Out Calculator · Your home's current market value — an estimate of the amount it would sell for in the current real estate market · Your. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. Lenders set interest rates on cash-out refis according to numerous economic factors, including inflation, treasury bond movement and housing market trends. The.

How To Calculate Principal And Interest On A Loan

:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

The function that calculates the interest and principal components of any single payment on your BAII Plus calculator is called AMORT. It is located on the 2nd. Principal & Interest Payment Calculator. This calculator will help you to determine the principal and interest breakdown on any given debt payment. Enter the. In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is. Next, the schedule shows how much of the payment is applied to interest and how much is applied to the principal over the duration of the loan. In the last. You can calculate interest paid on a mortgage loan using the interest rate, principal value (property price), and the terms of the loan (the duration and. Next take the mortgage principal and multiply it by one twelfth of the stated interest rate. That is the interest portion of the monthly payment. To find the principal, divide the amount of interest by the product of the interest rate and the time of the loan in years. What is the difference between the. Also included are optional fields for taxes, insurance, PMI, and association dues. Mortgage loan amount: Mortgage interest rate (%): Mortgage loan term (# years). It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that. The function that calculates the interest and principal components of any single payment on your BAII Plus calculator is called AMORT. It is located on the 2nd. Principal & Interest Payment Calculator. This calculator will help you to determine the principal and interest breakdown on any given debt payment. Enter the. In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is. Next, the schedule shows how much of the payment is applied to interest and how much is applied to the principal over the duration of the loan. In the last. You can calculate interest paid on a mortgage loan using the interest rate, principal value (property price), and the terms of the loan (the duration and. Next take the mortgage principal and multiply it by one twelfth of the stated interest rate. That is the interest portion of the monthly payment. To find the principal, divide the amount of interest by the product of the interest rate and the time of the loan in years. What is the difference between the. Also included are optional fields for taxes, insurance, PMI, and association dues. Mortgage loan amount: Mortgage interest rate (%): Mortgage loan term (# years). It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that.

Simple interest formula. Here is the mathematical formula, on which a simple interest calculator works to compute the loan amount: · A = P (1+RT). To calculate. Interest Rate is the APR from the loan rate chart. · # of Payments is the number of monthly payments you will make to pay off the loan. · Principal is the amount. In this, "a" stands for the total loan amount, "r" for the periodic interest rate, "n" for the total number of payment periods, and "p" for the monthly payment. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent of. click to expand contents The Principal and Interest Calculator provides a schedule of your monthly repayments and shows you what portion goes towards interest. = P × R × T,. Where,. P = Principal, it is the amount that initially borrowed from the bank or invested. R = Rate of Interest, it is at which. Step 2: Substitute these values into the simple interest formula, A = P(1+rt). Step 3: Solve for P, the principal. How to Find the Principal of a Simple. Next take the mortgage principal and multiply it by one twelfth of the stated interest rate. That is the interest portion of the monthly payment. This calculator will help you figure out how much you're paying toward the principal and what you're paying in interest. Original principal amount borrowed: Annual interest rate: Original loan term (# of months). Original monthly payment amount: Month and year of first payment. The formula to determine simple interest is an easy one. Just multiply the loan's principal amount by the annual interest rate by the term of the loan in years. First, convert your annual interest rate from a percentage into a decimal format by diving it by · Next, divide this number by 12 to calculate the monthly. The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a. Subtract the interest from your current debt. The amount left is what you owe towards your loan principal. · Deduct the above amount from your original principal. Formula for calculation of interest rate payments on self amortising loan (equal repayments of principal). L = loan amount r = interest rate n = tenor of the. This calculator will help you to determine the principal and interest breakdown on any given payment number. Obtain the new principal balance of your loan from your Online Banking Account Services page or the automated phone service. 2. Multiply your principal. Multiply this result by your principal to find out your monthly loan payment. For instance, you take out a $50, mortgage and receive a 5% interest rate. Your. Calculate how much of your home loan repayments form a part of your principal and interest amounts. The major variables in a mortgage calculation include loan principal, balance, periodic compound interest rate, number of payments per year, total number of.

Best High Tech Mutual Funds

Technology Sector Equity Funds and ETFs are mutual funds that focus on a basket of technology sector stocks. The tech sector features companies in various. Regulation best interest An increase in interest rates may cause the price of bonds and bond mutual funds to decline. Nuveen High Yield Fund (Retail) TIYRX. High. This fund scores Above Average because it delivered returns that were in the top % when compared to other funds within its Morningstar category. The Fund seeks long-term capital appreciation by investing primarily in equity and equity-related securities of technology or technology-related companies. Best Technology Mutual Funds ; Tata Digital India Fund(G)-Direct Plan · 11, ; Tata Digital India Fund-Reg(G) · 11, ; ICICI Pru Technology. Mutual funds are a popular way to invest in securities. Because mutual funds Sometimes, mutual funds get so large that they close to new investors. Best Technology Funds · #1. Fidelity Advisor® Semiconductors Fund FELAX · #2. Fidelity® Select Technology Portfolio FSPTX · #3. Fidelity® Select Software & IT Svcs. Top schemes of Sectoral-Technology Mutual Funds sorted by Returns ; Tata Digital India Fund. #3 of 5 ; Franklin Templeton. Franklin India Technology Fund. #2 of 5. Fidelity Blue Chip Growth (FBGRX) · Shelton Nasdaq Index Investor (NASDX) · Victory Nasdaq Index (USNQX) · Fidelity Large Cap Growth Index (FSPGX). Technology Sector Equity Funds and ETFs are mutual funds that focus on a basket of technology sector stocks. The tech sector features companies in various. Regulation best interest An increase in interest rates may cause the price of bonds and bond mutual funds to decline. Nuveen High Yield Fund (Retail) TIYRX. High. This fund scores Above Average because it delivered returns that were in the top % when compared to other funds within its Morningstar category. The Fund seeks long-term capital appreciation by investing primarily in equity and equity-related securities of technology or technology-related companies. Best Technology Mutual Funds ; Tata Digital India Fund(G)-Direct Plan · 11, ; Tata Digital India Fund-Reg(G) · 11, ; ICICI Pru Technology. Mutual funds are a popular way to invest in securities. Because mutual funds Sometimes, mutual funds get so large that they close to new investors. Best Technology Funds · #1. Fidelity Advisor® Semiconductors Fund FELAX · #2. Fidelity® Select Technology Portfolio FSPTX · #3. Fidelity® Select Software & IT Svcs. Top schemes of Sectoral-Technology Mutual Funds sorted by Returns ; Tata Digital India Fund. #3 of 5 ; Franklin Templeton. Franklin India Technology Fund. #2 of 5. Fidelity Blue Chip Growth (FBGRX) · Shelton Nasdaq Index Investor (NASDX) · Victory Nasdaq Index (USNQX) · Fidelity Large Cap Growth Index (FSPGX).

Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. Got the inside scoop on an upstart software company or a great no-load fund that has skyrocketed in the past six months? Murphy shows you how to evaluate. Financial Intermediaries / Mutual Funds / Global Technology Fund. Download Top 10 Holdings; Full Holdings; Purchases & Sales; Contributors & Detractors. are looking for the high growth potential of science and technology stocks Fund facts (mutual funds) · Fund facts (RBC iShares ETFs) · PFIC reporting. Every Investor's Guide to High-Tech Stocks and Mutual Funds, 3rd Edition: Proven Strategies for Picking High-Growth Winners [Murphy, Michael] on heic-jpg.ru NYLI MacKay Short Duration High Income Fund. Fixed Income. A. High Yield Bond The top 10% of products in each product category receive 5stars, the. mutual funds in its Morningstar Category. In each Morningstar Category, the top 10% of funds earn a High Morningstar Return (HIGH), the next % Above. Top 3 Technology Mutual Funds for · Fidelity Select Semiconductors Portfolio (FSELX) · Columbia Seligman Global Technology Fund (CGTYX) · Columbia Seligman. mutual funds. Because the fund tends to invest a relatively high percentage of its assets in its ten largest holdings, fluctuations in the market value of a. If you're not afraid of a bit more risk or a bias toward the technology sector, the Fidelity Select Semiconductors Portfolio (FSELX, $) is one of the. Best mutual funds · Fidelity Index Fund (FXAIX) · Why it made our list · Pros and cons · More details · Fidelity Total Market Index Fund (FSKAX) · Why it made our. ICICI Prudential Technology Mutual Fund is one of the oldest and most trusted technology sector funds in the market. This diversified fund aims to deliver long-. Overvaluation of Tech Stocks: Many tech stocks are trading at incredibly high price-to-earnings ratios, far beyond their historical averages. Returns. Low · High ; Expenses. Low · High ; Risk of this Type of Fund. Lower. Higher. Mutual fund managers are legally obligated to follow the fund's stated mandate and to work in the best interest of mutual fund shareholders. High-Tech Fund.". The fund's main risk is its narrow scope—it invests solely in information technology stocks. An investor should expect high volatility from the fund, which. Top Equity Holdings | View all ; Microsoft, ; Broadcom, ; Amazon, ; Alphabet 'A', Investors who want international diversification and specific exposure to the global technology sector · Those who are willing to accept the high risk of. MFS Technology Fund Class C MTCCX ; NAV, Change, Net Expense Ratio ; $, (%), % ; Quote data as of close 09/06/ The best mutual funds bet big on tech stocks like Nvidia, as well as long-term leaders GOOGL stock, Microsoft, ServiceNow and many more. Business partnership.

Consolidation Loans For Good Credit

Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair. Debt° Consolidation Loan. Debt consolidation can help when you have many loans across several financial institutions. The variety of terms, rates and monthly. LightStream is a solid option for good-credit borrowers, with no fees and low rates that vary based on loan purpose. Qualifications: Minimum credit score: Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover: Best for easy borrowing experience · Best Egg: Best for borrowers. Debt consolidation is the process of using a personal loan to pay off multiple lines of credit debt and/or other debts. Debt consolidation could be a good idea. Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR. Debt consolidation loans are offered by banks and a wide variety of lending companies, a not-for-profit credit counselling organization can also help put. Pay off your credit card debt with a debt consolidation loan. Find great rates to pay less in interest and minimize monthly bills into a single payment. Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair. Debt° Consolidation Loan. Debt consolidation can help when you have many loans across several financial institutions. The variety of terms, rates and monthly. LightStream is a solid option for good-credit borrowers, with no fees and low rates that vary based on loan purpose. Qualifications: Minimum credit score: Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover: Best for easy borrowing experience · Best Egg: Best for borrowers. Debt consolidation is the process of using a personal loan to pay off multiple lines of credit debt and/or other debts. Debt consolidation could be a good idea. Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR. Debt consolidation loans are offered by banks and a wide variety of lending companies, a not-for-profit credit counselling organization can also help put. Pay off your credit card debt with a debt consolidation loan. Find great rates to pay less in interest and minimize monthly bills into a single payment.

Credit Card Consolidation Loans: Pay Off High-Interest Debt. Combine all your debt into one monthly payment with a loan that has a lower interest rate. Debt consolidation loans present a good solution for debt that is spread across multiple lenders like credit cards. It cuts your loans down to one at a lower. The best candidates to get a debt consolidation loan are naturally people with good or excellent credit. They can qualify for rates as low as % in some. Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your debts more. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Pros · Cons · Upstart: Best for borrowers with bad credit. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. It is an efficient, affordable way to manage credit card debt, either through a debt management plan, a debt consolidation loan or debt settlement program. If. When you get a consolidation loan and make all your payments in full and on time, it shouldn't have a negative impact on your credit score. If anything, it. Debt consolidation loans and credit card consolidation loans from LightStream. We offer low-interest, fixed-rate loans for individuals with good to. Why choose Upstart for a debt consolidation loan? We think you're more than your credit score. Our model looks at other factors, like education³ and. LightStream: Best for high-dollar loans and longer repayment terms. LightStream · ; Upstart: Best for little credit history. Upstart · Not only can debt consolidation help you save money, it can also help you feel more financially organized. When you apply for a debt consolidation loan, the. Those who get turned away at the banks need another option, so they look to other lenders who can offer both secured and unsecured loans. For example, some. Why SoFi for credit card consolidation loans? · Fast and easy application process · Flexible loan options · Pay lenders directly · 24/7 member support and financial. Debt Consolidation Loans for Bad Credit in September ; Upstart logo · · % - % ; prosper logo · · % - % ; upgrade logo · · % -. Reach Financial: Best for quick funding. Reach Financial logo · 14 · % - % · Free monthly credit score ; Upstart: Best for borrowers with bad credit. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan. If you're juggling multiple credit cards and/or loans, consolidating them could save you money — and time. Use our debt consolidation calculator to see how you. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. You can consolidate your debts by applying for a consolidation loan. Or if a loan isn't right for you, an alternative can be enrolling your credit card debt.

What Are The Best Interest Rates Today

Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. Compare accounts to find the best bank interest rates for your financial goals View today's business rates on CDs, savings and more. Learn More. Still. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate. As of Sept. 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. Compare accounts to find the best bank interest rates for your financial goals View today's business rates on CDs, savings and more. Learn More. Still. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate. As of Sept. 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't.

Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. Additionally, the current national average year fixed mortgage rate increased 1 basis point from % to %. The current national average 5-year ARM. Rates · High-Rate Savings. %APY. %. Dividend Period, Monthly. Effective Date, 8/9/ Learn More · High-Rate Checking. %APY. %. Dividend. rate to %, also the highest since Investors will also keep a close eye The table has current values for Interest Rate, previous releases. The best high-yield savings account rate from a nationally available institution is % APY, available from Poppy Bank. Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Compare our current interest rates ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo loans, %, %. Mortgage rates ; Today's rate. year fixed (new purchase). As low as. · ; Today's rate. year fixed (new purchase). As low as. · The best high-yield savings accounts have annual percentage yields, or APYs, that are about 10 times higher than the national average rate of %. Many of. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Top 20 highest savings rates on the market for September These rates are current as of 9/5/ Explore what a lower interest Next steps: How to get the best interest rate on your mortgage. When you're. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no. Presently, the lowest fixed interest rate on a fixed reverse mortgage is % (% APR), and variable rates are as low as % with a margin. The current interest rate of % (% Annual Percentage Yield [APY]) is accurate as of September 4, for Market Monitor accounts opened with a minimum. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. How do I get the best mortgage rate? The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps.